In today’s fast-paced digital economy, businesses of all sizes are seeking ways to streamline operations, reduce costs, and enhance customer experiences. One critical area ripe for transformation is financial management, particularly billing. Traditional on-premise billing systems, reliant on local servers and manual processes, are increasingly outdated, unable to keep up with the demands of modern commerce. Enter cloud-based billing solutions like Bills.Monster, which offer a scalable, flexible, and efficient alternative. This 3000-word blog post explores the myriad benefits of switching to a cloud-based billing solution, highlighting why platforms like Bills.Monster represent the future of finance.

The Evolution of Billing: From Paper to Cloud

Billing has come a long way from handwritten invoices and ledger books. The advent of desktop-based accounting software in the 1980s and 1990s marked a significant leap, but these systems still required substantial hardware investments and IT maintenance. Today, cloud-based billing solutions are revolutionizing financial management by leveraging the power of the internet, automation, and real-time data. According to Allied Market Research, the global cloud billing market was valued at $3.9 billion in 2021 and is projected to reach $15.8 billion by 2031, growing at a CAGR of 15.3%. This explosive growth underscores the shift toward cloud-based platforms as businesses recognize their transformative potential.

Cloud-based billing solutions, such as Bills.Monster, host data and applications on secure remote servers, accessible via the internet. Unlike on-premise systems, they require no local hardware or extensive IT support, making them ideal for businesses ranging from freelancers to enterprises. Below, we’ll explore the key benefits of switching to a cloud-based billing solution, with a focus on how Bills.Monster empowers businesses to thrive in the digital age.

1. Cost Savings and Scalability

One of the most compelling reasons to switch to a cloud-based billing solution is the significant cost savings it offers. Traditional on-premise systems involve substantial upfront and ongoing expenses, while cloud platforms like Bills.Monster provide a cost-effective alternative.

Reduced Capital and Operational Expenses

On-premise billing systems require businesses to invest in servers, software licenses, and IT infrastructure. Additionally, ongoing costs for maintenance, upgrades, and IT staff can strain budgets. In contrast, cloud-based solutions operate on a subscription or pay-as-you-go model, eliminating the need for upfront hardware purchases. Bills.Monster, for instance, offers lifetime access for a one-time payment, further reducing long-term costs compared to recurring subscription models. By hosting services in the cloud, businesses also save on energy costs, as they no longer need to power and cool server rooms.

Scalability for Growth

Businesses evolve, and their billing systems must keep pace. On-premise systems often require costly hardware upgrades to handle increased transaction volumes or new features. Cloud-based solutions, however, are inherently scalable, allowing businesses to adjust resources dynamically based on demand. Bills.Monster’s flexible platform supports businesses from solo freelancers to growing enterprises, enabling users to add clients, manage multiple companies, or expand internationally without infrastructure overhauls. This scalability ensures that businesses can grow without being constrained by their billing system.

No Maintenance Burden

Maintaining on-premise systems is a time- and resource-intensive task, requiring regular software updates, security patches, and hardware repairs. Cloud-based platforms like Bills.Monster shift this responsibility to the provider, who handles updates and maintenance automatically. This frees businesses from the burden of IT management, allowing them to focus on core operations.

By offering cost savings, scalability, and zero maintenance, Bills.Monster makes financial management accessible and affordable for businesses of all sizes.

2. Accessibility and Flexibility

In today’s remote and hybrid work environments, accessibility is paramount. Cloud-based billing solutions provide unparalleled flexibility, enabling users to manage finances from anywhere, on any device.

Work from Anywhere

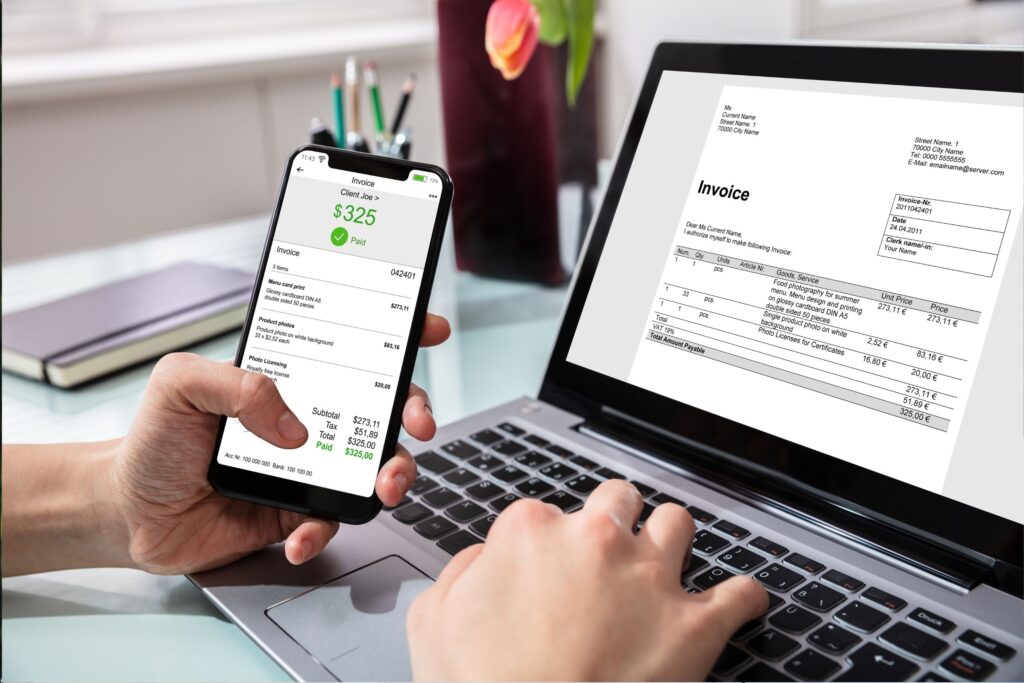

Unlike on-premise systems, which tie users to specific workstations, cloud-based platforms like Bills.Monster are accessible via the internet. Whether you’re in the office, at a client meeting, or working from a coffee shop, you can create invoices, track payments, or review financial reports using a laptop, tablet, or smartphone. This mobility is especially valuable for freelancers, small business owners, and distributed teams who need to stay connected on the go.

Cross-Device Compatibility

Bills.Monster’s cloud-based interface is designed to work seamlessly across devices, ensuring a consistent user experience whether you’re using a Windows PC, Mac, or mobile device. This eliminates the need for specialized software installations and ensures that your billing system is always at your fingertips.

Real-Time Collaboration

For businesses with multiple team members or external accountants, cloud-based solutions facilitate collaboration. Bills.Monster supports multiple users with role-based permissions, allowing team members to access specific features without compromising sensitive data. For example, a bookkeeper can manage invoices while a freelancer reviews client communications, all within the same platform. This real-time collaboration reduces delays and enhances productivity.

By providing anytime, anywhere access, Bills.Monster empowers businesses to operate with agility and efficiency in a dynamic world.

3. Automation for Efficiency

Manual billing processes are prone to errors and inefficiencies, costing businesses time and money. Cloud-based billing solutions leverage automation to streamline workflows, and Bills.Monster excels in this area.

Automated Invoicing

Creating invoices manually is a repetitive task that diverts attention from revenue-generating activities. Bills.Monster automates invoicing with customizable templates and pre-filled fields, allowing users to generate professional invoices in minutes. For recurring clients, such as those on retainers or subscriptions, Bills.Monster’s recurring invoice feature automates billing cycles, sending invoices on schedule without user intervention. This is particularly beneficial for SaaS businesses or freelancers with ongoing contracts.

Payment Reminders

Chasing late payments is a common pain point for businesses. Bills.Monster’s automated payment reminders notify clients of upcoming or overdue invoices, reducing the need for awkward follow-up emails. Users can customize reminder schedules and messages, maintaining professionalism while improving payment timeliness. This automation not only saves time but also enhances cash flow.

Integrated Payment Processing

Bills.Monster integrates with popular payment gateways like PayPal and Stripe, allowing clients to pay invoices online with a single click. This eliminates the need for manual payment processing and speeds up collections. Real-time payment tracking further reduces administrative overhead by showing when invoices are viewed, paid, or overdue.

Error Reduction

Manual data entry is a leading cause of billing errors, such as incorrect totals or misapplied taxes. Bills.Monster’s automated calculations ensure accuracy for subtotals, taxes, and discounts, minimizing the risk of mistakes that could damage client trust or require rework.

By automating invoicing, reminders, and payments, Bills.Monster saves businesses hours each week, allowing them to focus on growth and innovation.

4. Enhanced Security and Compliance

Handling financial data requires robust security and compliance measures. Cloud-based billing solutions offer superior protection compared to on-premise systems, and Bills.Monster prioritizes data safety.

Secure Data Storage

On-premise systems are vulnerable to physical threats like theft, fire, or hardware failure. Cloud-based platforms store data on secure, encrypted servers with redundant backups, ensuring data integrity even in the event of a disaster. Bills.Monster uses industry-standard encryption to protect client information, payment details, and financial records, giving users peace of mind.

Compliance with Regulations

Navigating tax regulations, such as GDPR in Europe or CCPA in California, can be complex for businesses. Bills.Monster simplifies compliance by allowing users to configure tax rates and apply them automatically to invoices. Its multi-currency and multi-language support ensures that invoices meet local requirements for international clients, reducing the risk of non-compliance. Additionally, Bills.Monster’s audit-ready reports make it easy to provide financial data during tax season or audits.

Regular Updates

Cloud-based platforms receive automatic updates to address security vulnerabilities and regulatory changes, unlike on-premise systems that require manual patches. Bills.Monster’s provider ensures the platform remains compliant with evolving standards, protecting users from potential risks.

By prioritizing security and compliance, Bills.Monster builds trust with clients and safeguards businesses against financial and legal risks.

5. Seamless Integration and Ecosystem Connectivity

Modern businesses rely on a suite of tools, from CRM to accounting software. Cloud-based billing solutions excel at integrating with other systems, creating a cohesive financial ecosystem.

Integration with Business Tools

Bills.Monster integrates with popular tools like CRMs, ERPs, and payment gateways, enabling seamless data flow between systems. For example, client data from a CRM can auto-populate invoices, while payment data syncs with accounting software like QuickBooks or Xero. This integration reduces manual data entry, minimizes errors, and ensures consistency across platforms.

Customer Self-Service Portals

Bills.Monster’s client portal allows customers to view payment histories, download invoices, and make payments directly, reducing the need for back-and-forth communication. This self-service functionality enhances customer satisfaction and frees up business owners’ time.

API and Customization

For businesses with unique needs, Bills.Monster offers robust APIs and customization options, allowing users to tailor workflows, reports, or integrations. This flexibility ensures that the platform adapts to your business, not the other way around.

By fostering connectivity, Bills.Monster creates a unified financial ecosystem that drives efficiency and customer loyalty.

6. Real-Time Insights and Reporting

Data-driven decision-making is essential for business success, but manual reporting can be time-consuming. Cloud-based billing solutions provide real-time insights, and Bills.Monster’s reporting tools are a standout feature.

Comprehensive Financial Reports

Bills.Monster offers pre-built reports on invoicing, expenses, and financial performance, filterable by date, client, or company. Users can export reports in formats like PDF or CSV for sharing with accountants or stakeholders. These reports provide visibility into cash flow, outstanding invoices, and spending patterns, enabling informed decisions.

Cost Optimization

By tracking revenue and expenses in real-time, Bills.Monster helps businesses identify inefficiencies, such as late-paying clients or excessive costs. For example, a freelancer might notice that a client consistently pays late and adjust payment terms accordingly. These insights drive profitability without hours of manual analysis.

Forecasting and Budgeting

Bills.Monster’s data can inform forecasting and budgeting, helping businesses plan for growth or seasonal fluctuations. By integrating with budgeting tools, users can set spending alerts to stay within financial goals, ensuring long-term stability.

By delivering actionable insights, Bills.Monster empowers businesses to optimize their financial performance with minimal effort.

7. Global Reach with Multi-Currency and Multi-Language Support

For businesses operating internationally, cloud-based billing solutions simplify global transactions. Bills.Monster’s multi-currency and multi-language features make it ideal for cross-border commerce.

Localized Invoicing

Bills.Monster allows users to create invoices in a client’s preferred currency or language, with automatic currency conversions and translations. This eliminates manual adjustments and ensures compliance with local tax regulations, such as VAT or GST.

Expanded Market Opportunities

By supporting global clients, Bills.Monster enables businesses to expand into new markets without the logistical challenges of traditional billing systems. For example, a freelancer in the U.S. can invoice clients in Europe or Asia seamlessly, fostering international growth.

Unified Financial Management

For businesses managing multiple currencies, Bills.Monster consolidates financial data into a single dashboard, simplifying reporting and analysis. This unified view saves time and ensures accuracy across global operations.

By enabling global reach, Bills.Monster positions businesses to compete in the global marketplace with ease.

8. Customer Satisfaction and Retention

Billing is a critical touchpoint in the customer journey, and a seamless process can enhance client relationships. Cloud-based solutions like Bills.Monster prioritize customer experience, driving loyalty and retention.

Professional Invoices

Bills.Monster’s customizable templates create branded, professional invoices that reflect a business’s identity. Clear, detailed invoices reduce confusion and disputes, fostering trust with clients.

Convenient Payment Options

By integrating with payment gateways, Bills.Monster offers clients multiple payment methods, from credit cards to digital wallets. This convenience encourages timely payments and enhances the customer experience.

Transparency and Trust

Bills.Monster’s client portal provides transparency by allowing customers to access payment histories and invoices. This self-service approach builds trust, as clients feel empowered and informed. According to a McKinsey report, 71% of consumers would stop doing business with a company that shares sensitive data without permission, underscoring the importance of trust in billing.

By prioritizing customer satisfaction, Bills.Monster helps businesses retain clients and attract referrals.

Why Bills.Monster is the Future of Finance

Cloud-based billing solutions are reshaping the financial landscape, and Bills.Monster is at the forefront of this transformation. Its comprehensive feature set—ranging from automation and scalability to security and global support—makes it a standout choice for businesses seeking to modernize their billing processes. Here’s why Bills.Monster is the future of finance:

- Affordable Pricing: Lifetime access for a one-time payment eliminates recurring fees, making it cost-effective for businesses of all sizes.

- User-Friendly Interface: Intuitive design ensures that users, even those without accounting expertise, can manage finances effortlessly.

- Comprehensive Tools: From invoicing and expense tracking to CRM and inventory management, Bills.Monster is an all-in-one solution.

- Future-Proof Technology: Cloud-based architecture and automatic updates keep the platform aligned with industry trends and regulations.

As businesses navigate a digital-first world, platforms like Bills.Monster offer the agility, efficiency, and innovation needed to thrive. Gartner predicts that 85% of organizations will adopt a cloud-first principle by 2025, and billing is no exception.

Conclusion: Embrace the Cloud with Bills.Monster

Switching to a cloud-based billing solution is no longer a luxury—it’s a necessity for businesses aiming to stay competitive. By offering cost savings, accessibility, automation, security, integration, insights, global reach, and enhanced customer experiences, platforms like Bills.Monster redefine financial management. Whether you’re a freelancer juggling multiple clients, a startup scaling rapidly, or an enterprise expanding globally, Bills.Monster provides the tools to streamline your billing process and drive growth.

Ready to embrace the future of finance? Visit Bills.Monster today to discover how a cloud-based billing solution can transform your business. Say goodbye to outdated systems and hello to a smarter, more efficient way to manage your finances.